Visa study : More than 70% of UAE retailers see increase in revenue and customer traffic since accepting digital payments

- Visa’s Value of Acceptance study also reveals 68% of digital payment accepting UAE merchants surveyed say accepting cards and mobile payments essential investment for business growth

- 40% of cash-only merchants surveyed plan on investing soon in digital payment technology

- Sixty-seven percent (67%) of digital payments accepting merchants claim most customers prefer paying by card or mobile phone

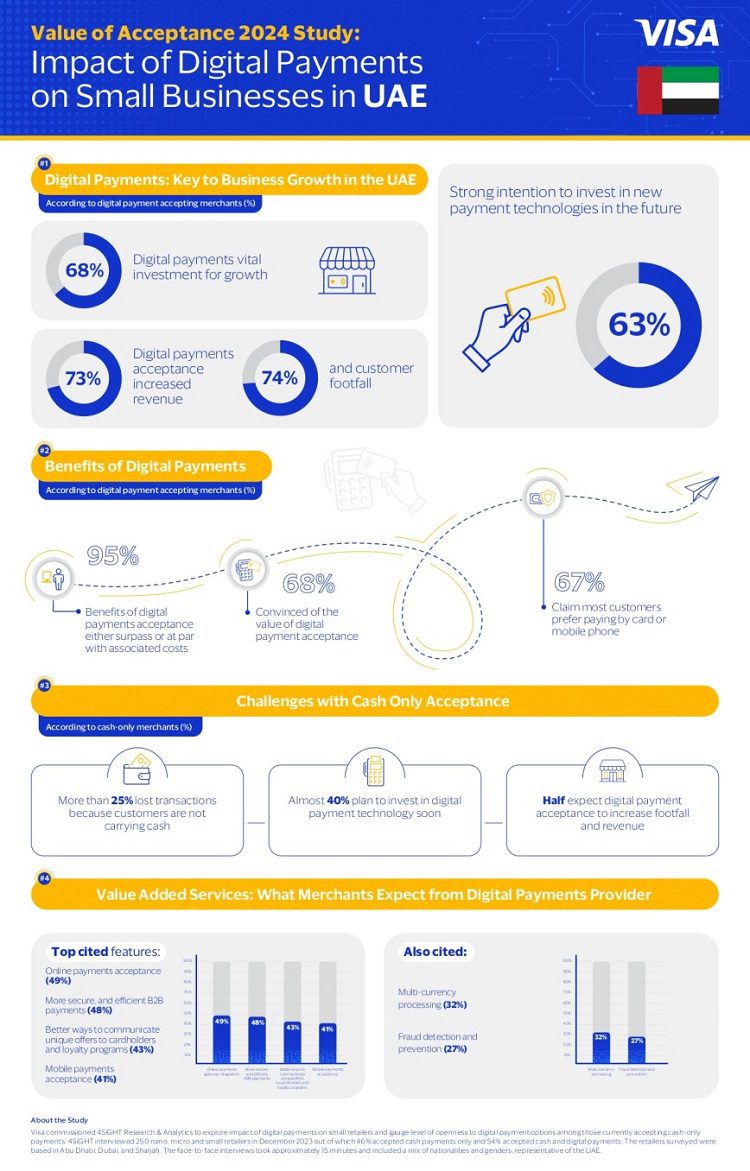

Dubai, United Arab Emirates (UAE), March 5, 2024: Visa (NYSE:V), a world leader in digital payments, has unveiled the results of an independent study titled ‘Value of Acceptance’, which explores merchants’ attitudes towards digital payments and the impact of digital commerce on small businesses and retailers in the UAE. According to the study, more than 70% of UAE merchants surveyed claim increased revenue and higher customer footfall since accepting digital payments.

The survey gathered insights from two groups of UAE-based merchants – those who have accepted digital payments for 1-4 years, and retailers who exclusively deal in cash transactions. The top five store types represented in the survey include quick service restaurants, small grocery stores, tailors, fashion/apparel stores, and laundry with business sizes including nano (2 or less employees), micro (3-10 employees), and small (11-49 employees).

According to the study, among card-accepting merchants both digital payments and cash together account for 90% of payments accepted among surveyed small businesses, with digital payments accounting for the larger portion.

Digital Payments: Business Growth Driver

The findings from Visa’s study show digital payments acceptance is an important driver in the growth of small businesses, with 68% of surveyed merchants accepting digital payments claimed acceptance of payment through card and mobile wallets is an essential investment that significantly contributes to their business growth. Sixty-seven percent (67%) of these merchants also claimed most of their customers prefer paying by card or mobile phone.

While digital payment-accepting merchants surveyed are aware of the associated costs with acceptance, 95% believe that the value and benefits derived from digital payment acceptance are at par with or exceed associated costs. In fact, 68% of retailers that accept digital payments are convinced of the overall value of digital payment acceptance, with 63% indicating a strong intention to invest in new payment technologies in the future.

Challenges with Cash Only Acceptance

While cash is associated with convenience and easy refunds, more than 25% of cash-only merchants have lost transactions because customers were not carrying cash. As a result, almost 40% of cash-only merchants surveyed plan on investing soon in digital payment technology so they can begin to offer consumers a better payment experience.

Around half expect digital payment acceptance to increase both footfall and revenue. Other digital payment benefits cited by merchants include speed with payment processing and checkout which makes businesses look more innovative.

Salima Gutieva, Visa’s VP and Country Manager for UAE, said: “As the UAE forges ahead with its ambitious digital commerce agenda, our ‘Value of Acceptance’ study underscores the transformative power of digital payments for the retail sector. Embracing digital transactions not only aligns with the UAE’s cashless society ambitions but also unlocks significant growth potential for small businesses as well as for the wider economy.”

Gutieva added: “Beyond the benefits of security, speed, and convenience, digital payments also provide invaluable data insights. With more consumers turning to digital payments, this data can assist merchants in tailoring communication, targeting offers more effectively, implementing loyalty programs, and enhancing the overall customer experience, among other advantages. These aspects are instrumental in boosting business profitability and efficiency.”

Merchant Expectations of Digital Payment Provider

Merchants that already accept digital payments expect a range of value-added services from their digital payments’ provider to enhance their payments infrastructure and offering for customers. The most frequently cited include: (i) Online payment acceptance (49%) (ii) more secure, and efficient B2B payments (48%) (iii) better ways to communicate unique offers to cardholders and loyalty programs (43%) and (iv) mobile payment acceptance (like Visa’s Tap to Phone solution) (41%). Additionally, multi-currency processing (32%) and fraud detection and prevention (27%) were revealed as areas where payment providers can further add value to local businesses.

About the Study

Visa commissioned 4SiGHT Research & Analytics to explore the impact of digital payments on small retailers and gauge their level of openness to digital payment options among those currently accepting cash-only payments. 4SiGHT interviewed 250 nano, micro and small retailers in December 2023 out of which 46% accepted cash payments only and 54% accepted cash and digital payments. The retailers surveyed were based in Abu Dhabi, Dubai, and Sharjah. The face-to-face interviews took approximately 15 minutes and included a mix of nationalities and genders, representative of the UAE.