Maintaining investment in brand is key for marketers responding to ‘stagflation’ and planning for recovery

WARC Guide to The Consumer Crunch: Navigating inflation and the threat of recession

As consumers in many markets endure the worst cost-of-living crunch in decades, the spotlight is on brands to adapt to changing behaviours and expectations while keeping business buoyant for the recovery.

However, the current economic downturn poses its own challenges for brands as they navigate new pressures on pricing, portfolio management, innovation, advertising and much more.

The WARC Guide to The Consumer Crunch, released today, aims to equip marketers with the knowledge and resources they need to make sound decisions in these difficult times. The Guide offers in-depth insight on consumer sentiment, pricing strategies, brand management and communications, backed with evidence, data and best-in-class case studies.

Lena Roland, Head of Content, WARC Strategy, and co-author of the report, says: “As consumers in most major markets start to adjust behaviours due to the sharp price rises seen this year, this Guide presents our latest research and evidence to help marketers respond to this period of instability.”

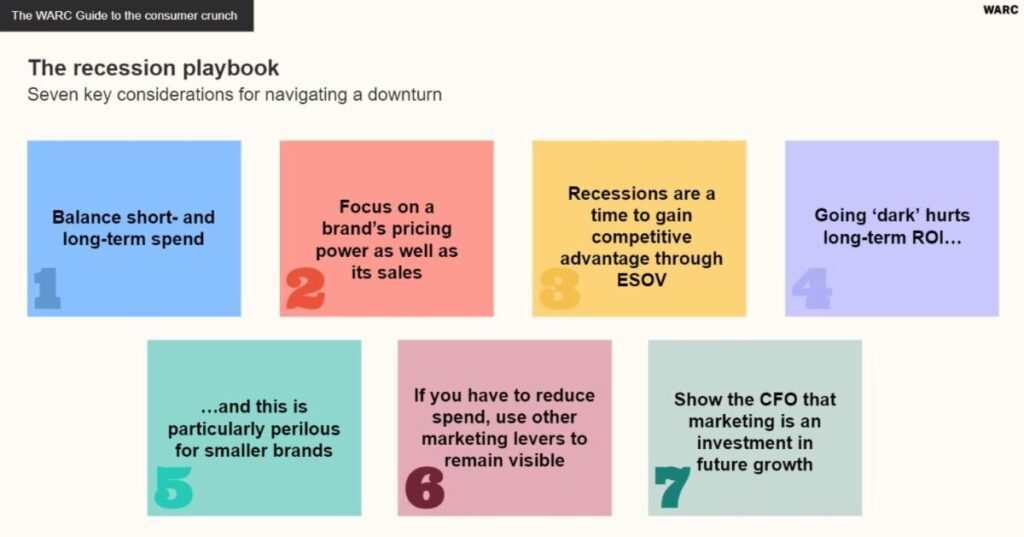

“It looks at the different levers marketers can use to justify price, the benefits of scenario planning, key considerations for brand portfolio management, and how to communicate during difficult times. Lastly, it presents marketing lessons from previous recessions, and how to plan for the recovery.”

Key takeaways outlined in the report are:

This is not a typical downturn

Sharp inflation AND the threat of recession (or ‘stagflation’) makes this period of instability particularly challenging for marketers, as rising prices amplify the effects of a downturn on consumer spend.

Geographically, the US looks in a stronger position than Europe but data suggests consumers in most major markets are starting to adjust behaviours. A study by First Insight found that 82% of consumers in France, Germany, Italy, Spain, UK and the US have less confidence to spend ahead of the Christmas holidays.

Consumer behaviours are already changing

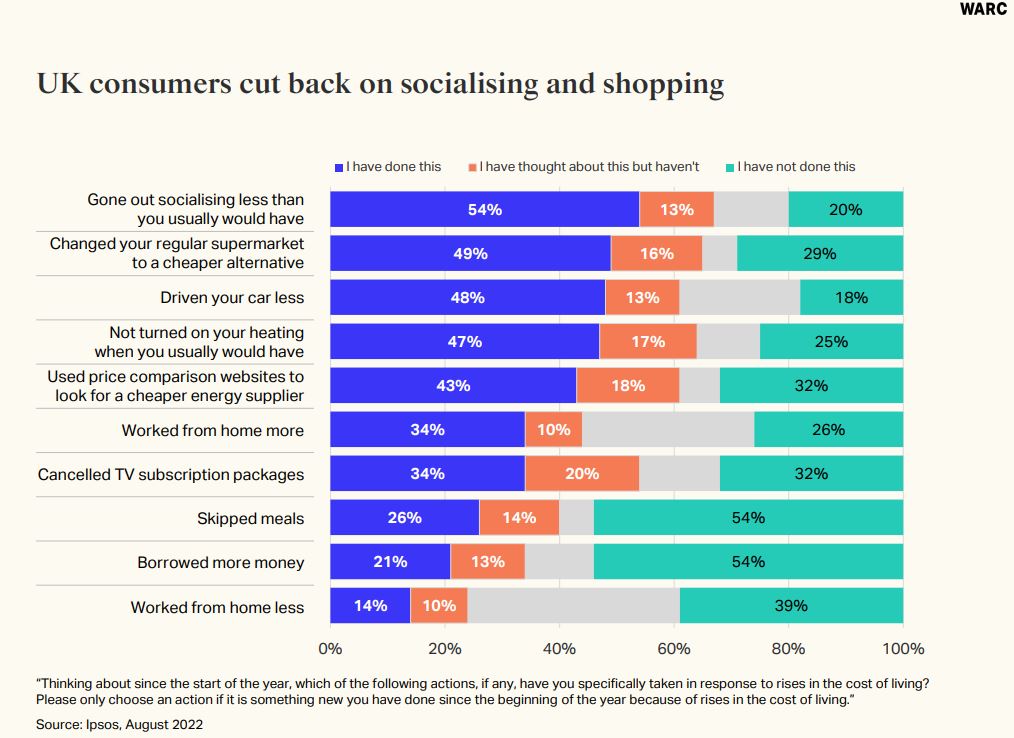

The evidence so far points to multiple small changes in discretionary spend – though the real test in Europe may come in winter as consumers face the impact of higher energy prices.

According to market research company Ipsos, more than half of UK consumers have already cut back on socialising, and 49% have switched supermarkets. Similar data from Rival Spark shows reduced socialising, switching retailers, using coupons and switching to private-label are all priorities for US and UK buyers.

Marketers need to maintain investment in their brands

Downturns often see brands scale back advertising spend and put a focus on ‘performance’ channels where its impact is more immediately measurable.

But marketers need to maintain investment in their brands as they seek to justify price increases (by reducing price elasticity) and defend themselves from trading down or private-label rivals.

Consistent and effective advertising increases a brand’s pricing power, no matter the economic situation.

Pricing moves into the spotlight

With consumer finances stretched, price inevitably becomes more of a factor in purchase decisions. Data modelling and testing can help brands understand price elasticity in the category, and to assess the impact of marketing investment on price.

Speaking to WARC at Cannes Lions in June, James Hankins, Founder, Vizer Consulting, said: “The earlier marketers use their other ‘P’, promotion, to build strength in a brand to justify that increase in price so [consumers] don’t go elsewhere, the better for your business.”

Innovation can support pricing or reframe value. Brands should rethink pack sizes, product bundles, or use investment in the product as a way to maintain price premiums and fight off private-label rivals.

A strong brand is a buffer against inflation

Strong brands with more brand equity drive greater commercial growth and are less price elastic. As consumers look for reassurance in their purchases, brands that have successfully communicated their value can continue to charge a price premium.

However, following analysis of 40,000 brands, Kantar estimates that roughly one-third do not have brand equity strong enough to support their pricing – leaving them vulnerable.

Communications for difficult times

Getting the tone and content of marketing right, especially when communicating price increases, is a delicate moment for brands to navigate to avoid alienating customers.

Brands should not fall into the trap of undifferentiated ‘sad’ communications. If it is in line with the brand’s voice, humour or light-heartedness can be a useful tool to capture attention.

Plan for recovery, not just recession

When recession strikes, a knee-jerk response often overrides long-term strategic thinking. Brand advertising is often cut as the marketing budget comes under pressure, and money is diverted into the channels that can be measured for direct sales impact. But it is crucial to consider the type of advertising to invest in, for short-, mid- and long-term growth.

Nancy Smith, CEO, Analytic Partners, says: “If we impact on our spend, and our competition doesn’t, or our competition leans in, well, then we can lose a significant portion of our business… And these are losses that will be sustained.”