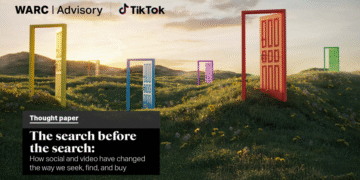

Global ad spend in publishing media set to decline 7.7% in 2023 to $47.2bn

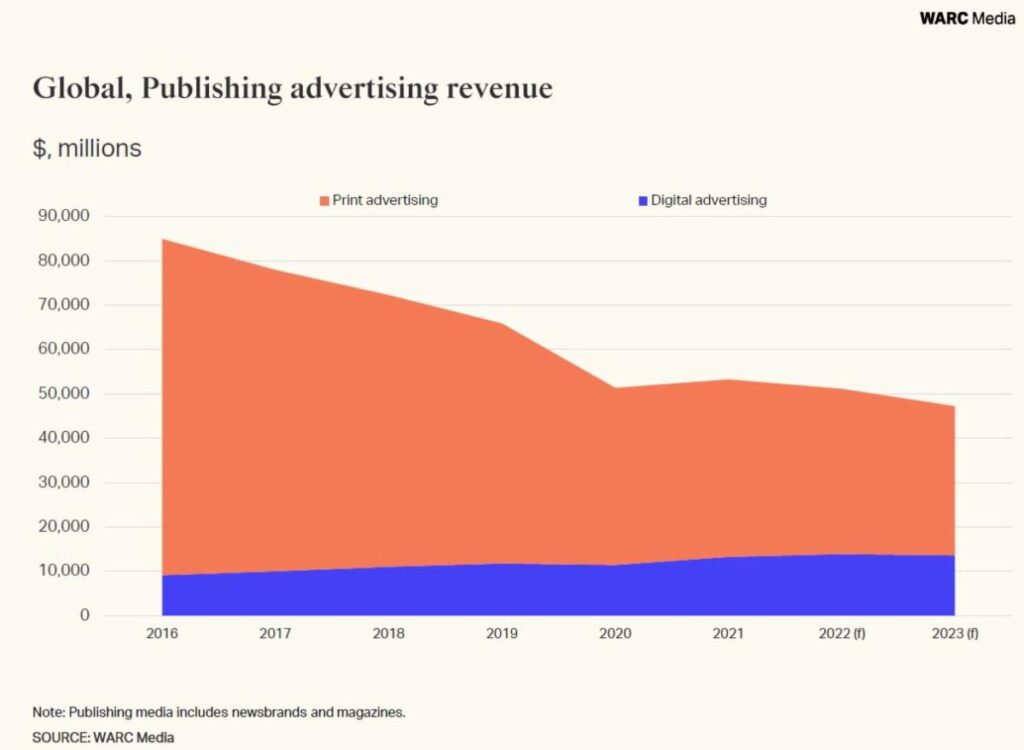

At $37.7bn, Amazon’s ad business alone is now worth more than the global print ad market

The media industry has entered a period of flux. What constitutes a media owner is being challenged by structural shifts in the global advertising market worth $993bn this year.

It is becoming harder for content-creating publishers to remain competitive against data-rich performance channels like retail media, and sustain publishing businesses through online display revenue alone, finds WARC in its latest Global Ad Trends report: Media models in flux.

Amazon earned $37.7bn from advertising services in 2022, almost the exact amount print was worth globally last year. The entire global publishing ad market will be worth $47.2bn in 2023, per WARC Media data, a decline of 7.7% year-on-year in 2023.

However, advertising remains an attractive, high-margin source of revenue, meaning media owners are evolving their operating models to survive.

Author of the report, Alex Brownsell, Head of Content, WARC Media, says: “For newsbrands and magazines, modest increases in digital ad revenue have been insufficient to compensate for print ad income losses. Global publishing print advertising revenue has halved in the last six years, from $75.9bn in 2016 to $37.3bn in 2022.

“While Meta is launching a paid verification service reducing its reliance on ad revenues, content-creating media owners have not given up on the ad market. Netflix and Spotify are just two platforms to see high margin advertising as a means of achieving profitability, and mitigating any softness in the subscription economy as consumers negotiate cost of living pressures.”

More than $4 in every $10 spent on advertising in any format globally goes to Alphabet, Amazon or Meta

In a programmatically-traded, data-driven digital advertising market, it is becoming harder for content-creating publishers to remain competitive.

Global spend on video, audio, publishing and OOH has scarcely shifted. WARC Media forecasts total investment in 2023 will be 1.6% higher than it was in 2016.

More than $4 in every $10 spent on advertising in any format globally now goes to Alphabet, Amazon or Meta.

Brian Morrissey, Media Analyst and Founder of The Rebooting, said: “The reality of the publishing industry is that you really cannot have an original content model that is mostly or solely reliant on display advertising revenue. Ad money is being eaten by retailers because they have really good data of what people purchase.”

Yet some publishers are thriving in the current market. The New York Times, often cited as the blueprint for a sustainable and scaled content business, prioritises cross-product ‘bundle’ sales with advertising having to fit within a broader vision for user experience. Niche publications like Washington DC-based Axios, Punchbowl and Politico, aim their products at influential audiences in the US capital.

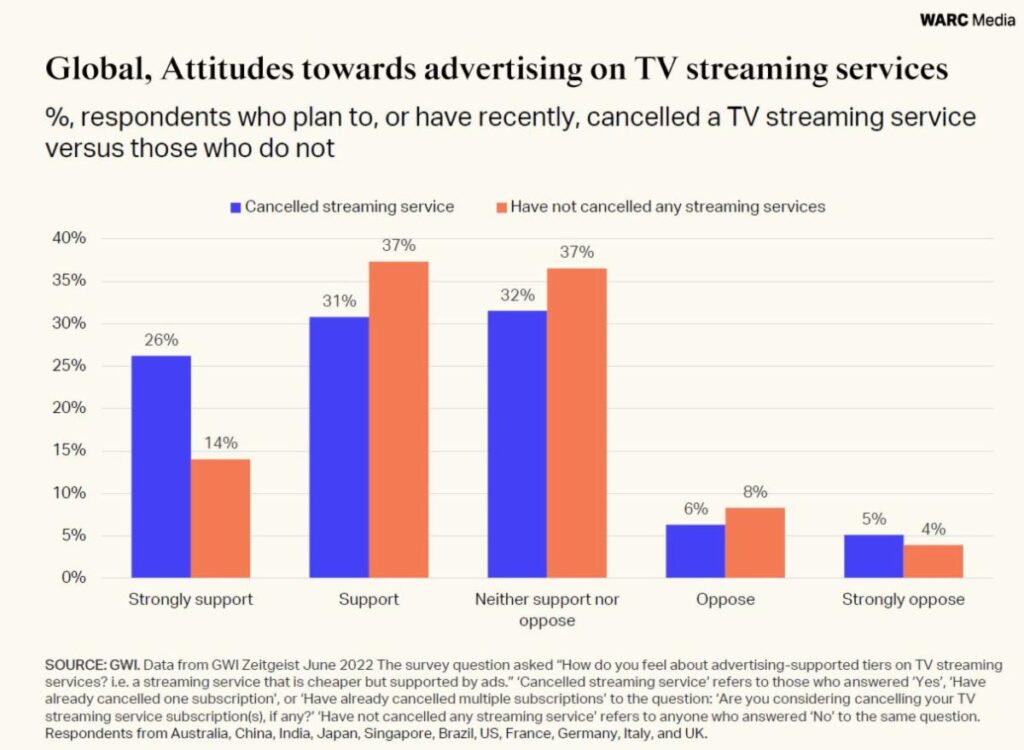

Globally, 57% of consumers cutting back on SVOD subscriptions favour ad-supported streaming services

While no longer sufficient to support many media owners in isolation, advertising remains an attractive, high-margin source of revenue.

Netflix recently pivoted to advertising, signalling a watershed moment in video and audio streaming. Disney+ and Warner Bros Discovery have adopted ‘hybrid’ paid and ad-funded models. Audio streaming platform Spotify is improving margins through more sophisticated podcast advertising.

Laura Chaibi, Director, International Ad Marketing and Insights, Roku, said: “After years of proliferation of SVOD services, key media players are now moving to ad-supported business models to cater to consumers’ desire to access content for free and save money.”

Data from Roku found that 47% of streaming viewers plan to make changes to their services in the next 12 months. And according to GWI, 57% of those cutting back on SVOD subscriptions favour ad-supported streaming services.

Global retail media is forecast to be the fastest-growing channel in 2023, reaching $122bn

The weakening of the historic bond between content, audiences and advertising is underpinning the upheaval in the media industry.

Retail media networks are forecast to become more valuable than linear TV by 2025. This rapid rise together with the deprecation of third-party cookies and greater privacy regulation, has led to content creating media owners looking to fulfil brand building requirements, and perform a role for advertisers higher up the purchase funnel.

Where legacy channels offer both digital and offline formats – video, audio, publishing and OOH – ad investment is increasingly likely to go to digital formats in CTV, audio streaming and DOOH.

Download a complimentary sample report of WARC Global Ad Trends: Media models in flux here.

Global Ad Trends, is a bi-monthly report which draws on WARC’s dataset of advertising and media intelligence to take a holistic view on current industry developments. It is part of WARC Media, which provides rigorous and accurate benchmarks aggregated and verified from over 100 reputable sources, empowering media decision makers to plan strategies with precision. WARC Media is available by subscription.