Global Ad Market Prospects Upgraded Following Social Media Windfall

- Growth forecasts for advertising spend have been upgraded this year (+1.2pp to +7.4%) to $1.17trn – the first uprating in more than 12 months.

- Alphabet, Amazon and Meta are set to take a combined market share of 55.8% excluding China this year – equivalent to $524.4bn – rising to 56.2% in 2026.

- Nine in ten dollars of ad market growth are going to online-only platforms.

- Global ad market growth is expected to accelerate to 8.1% next year – to a total of $1.27trn equivalent to $150 per capita.

- A rise of 7.1% is predicted in 2027, with a market total of $1.36trn double that of the pandemic hit year of 2020.

A new study from WARC, the experts in marketing effectiveness, has found that global advertising spend is now on course to grow 7.4% this year to $1.17trn, a marked upgrade of 1.2 percentage points (pp) from WARC’s June forecast due to an exceptional second quarter performance. A further rise of 8.1% is forecast next year, to $1.27, while growth of 7.1% in 2027 would push the market’s value to $1.36trn – a doubling in size since the pandemic.

James McDonald, Director of Data, Intelligence & Forecasting, WARC, and author of the report, says: “Global ad spend is growing rapidly, with digital-first platforms capturing almost all the new money. Despite economic headwinds, including disruption to global trade and reduced purchasing power among consumers, brands are doubling down on Meta, Alphabet and Amazon, while emerging players like TikTok are growing fast but from smaller bases. The global market is set to nearly double in value since the pandemic, underscoring the resilience of advertising in a tougher economic climate.”

WARC’s latest global projections are based on data aggregated from 100 markets worldwide, and leverage a proprietary neural network which projects advertising investment patterns based on over two million data points.

Ad spend continues to consolidate among three media owners

- Nine in ten dollars entering the ad market go towards online-only platforms.

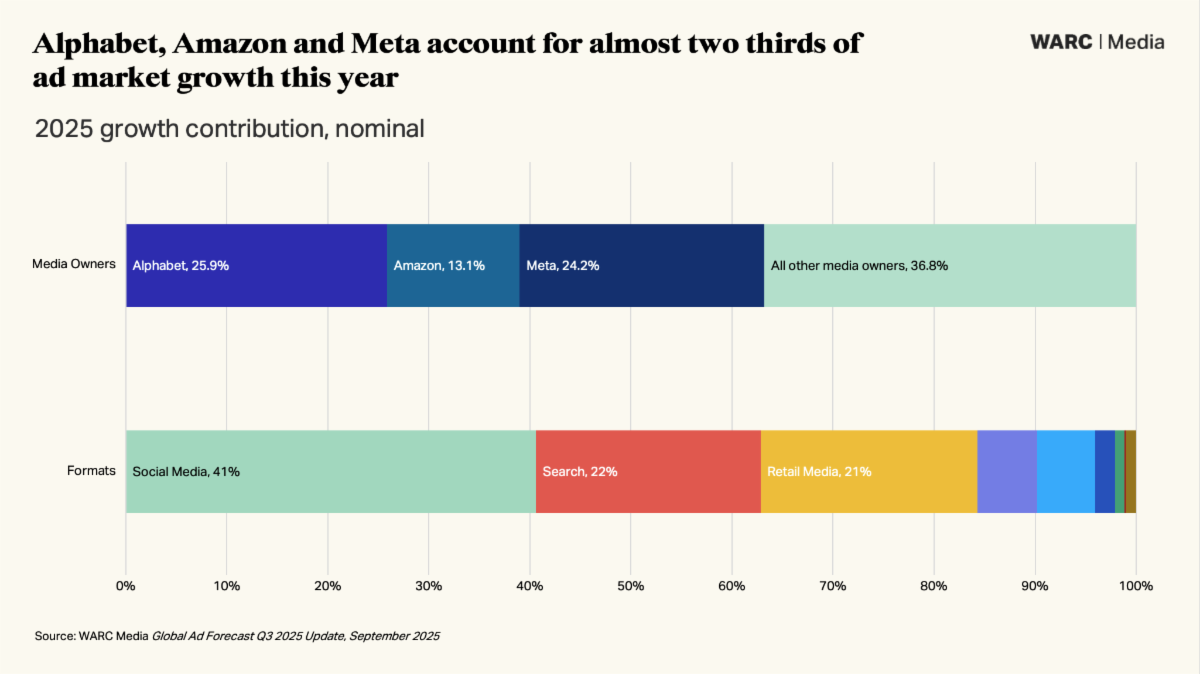

- Social media – the largest single advertising medium globally – is drawing a plurality (40.6%) of new ad dollars, while non-retail search (22.2%) and retail media (21.5%) each account for around a fifth of growth.

- Alphabet, Amazon and Meta draw over half (55.8%) of all ad spend outside of China; their share of total ad spend (excl. China) will top 60% by 2030.

The latest forecast data shows that nine in ten incremental ad dollars this year are paid to advertise on online-only platforms. This means that legacy media owners – even those with online properties in their portfolios – are competing over the course of the year for the equivalent of what Facebook makes in an average month.

Of all new ad dollars entering the market this year, two in five are going to a social media platform, one in five is going towards search advertising, and one in five is being paid to retail media platforms.

The owners of the largest platforms in these sectors – Meta, Alphabet and Amazon– now attract over half (55.8%) of total advertising spend outside of China, a share which is on track to top 60% by 2030.

Social media ad spend is projected to rise 14.9% this year to a total of $306.4bn, equivalent to over a quarter (26.2%) of all advertising spend in 2025. Further growth, of 12.8% and 11.9%, is forecast next year and into 2027, by when the social market is expected to be worth $386.9bn – equal to 28.5% of all ad spend.

Within this, Meta is expected to record growth of 14.8% this year, with a total of $184.1bn accounting for 60.1% of all social media spend and 15.7% of all ad spend worldwide. Meta’s share of the social market is expected to dip to 59.3% by 2027, owing to continuing growth of TikTok over the forecast period 2025-2027, though its share of total ad spend will still rise to 16.9%.

Instagram is still growing at a faster pace than the core Facebook platform, with growth averaging 16.4% over the forecast period compared to an average rise of 10.4% for Facebook.

TikTok continues to outpace both platforms, however, gaining market share in the process. Ad spend on TikTok is expected to average 21.6% over the forecast period, drawing 11.7% of all social media spend in 2027 (up from a share of 10.3% this year).

Search advertising spend is set to rise by an anticipated 10.0% this year to $253.2bn – equivalent to a fifth (21.6%) of all advertising spend. Google is the dominant player, with anticipated ad revenue of $217.8bn equal to 86% of the search market in 2025. This growth comes as the company faces a US antitrust hearing this week over a potential monopoly of the online ad market.

Advertising spend on retail media platforms is set to grow at an average rate of 12.6% over the forecast period, though this is a marked slowdown from previous years. Retail media ad spend is on course to rise 13.7% this year to a total of $175.0bn – a 14.9% share of global spend.

At an anticipated $62.0bn in 2025 (up 18.7% year-on-year), Amazon accounts for over a third (35.4%) of the retail media market and 5.3% of all ad spend, though its share of both is rising.

Social windfall in the second quarter driven by retailers and tech brands in the lead up to ‘Freedom Day’

- Sharp rises in ad spend among retailers were recorded on Instagram (+18.8%) and TikTok (+56.8%) during the second quarter, leading up to the introduction of new US trade tariffs on so called ‘Freedom Day’

- Retailers account for a quarter of all ad spend on Facebook, though growth here was more muted among this sector (+3.6%) during Q2 2025.

- Technology & electronics brands also lifted spend markedly on Instagram (+$501m) and TikTok (+$484m) during the second quarter of 2025, placing this as the second-largest product sector on both platforms, behind retail.

Pure play internet – encompassing social media, retail media, online display, online classified and paid search – grew 14.0% in the second quarter of 2025 to $205.1bn, equivalent to 71.9% of all global ad spend. The growth rate exceeded the 9.9% rise forecast owing to a windfall for social media companies ahead of incoming US trade tariffs.

The social media sector grew 20.2% in Q2 2025 versus a forecast of 12.4%, equivalent to $4.9bn more than anticipated.

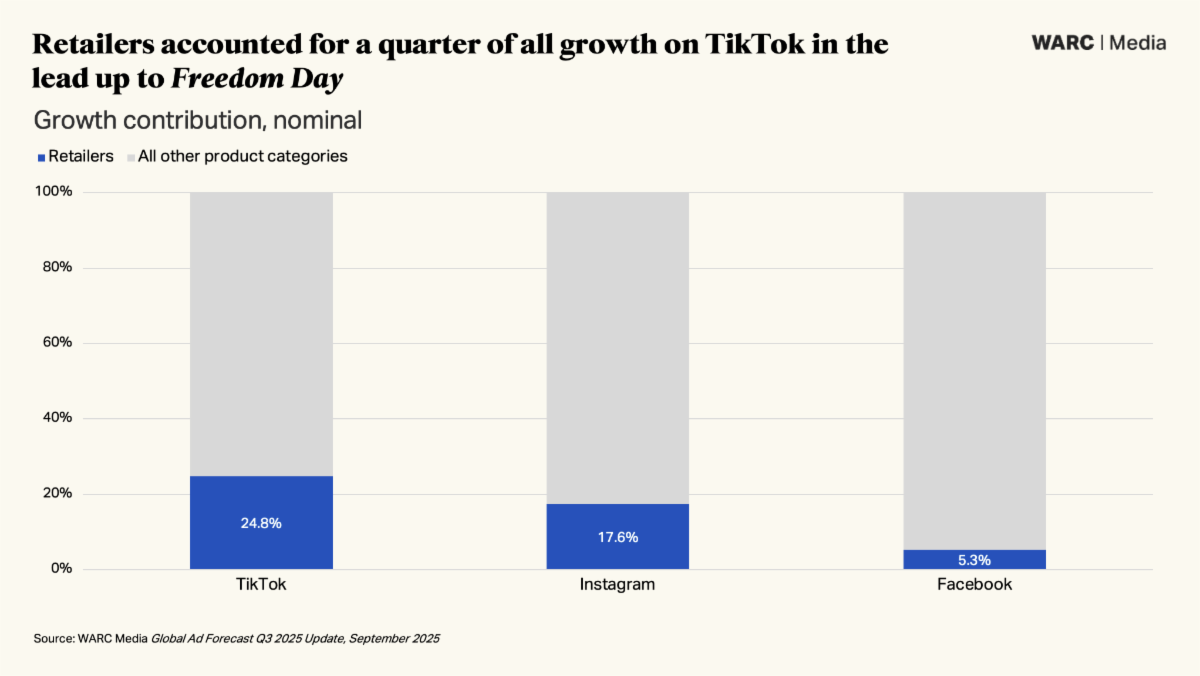

New monitoring from WARC and Nielsen sheds fresh light on spend within the social media sector. The newly developed dataset shows that a windfall in spend among retailers buoyed social media growth in the second quarter during the lead up to the introduction of new US trade tariffs on so called Freedom Day.

The enhanced monitoring shows that retail is the largest category on both Instagram and TikTok, with shares of approximately a quarter and a fifth, respectively. Retailers were seen to have increased spend on Instagram (+18.8%) and TikTok (+56.8%) at a much faster rate than on Facebook (+3.6%) during the second quarter, perhaps indicative of a wider strategic shift.

Looking at the delta – the absolute difference in spend between Q2 2024 and Q2 2025 – retailers increased Instagram spend by $651m – more than any other product category. The retail sector also recorded the highest delta on TikTok in Q2 2025, as spend rose by $661m. Remarkably, retailers accounted for a quarter (24.8%) of TikTok’s growth during the second quarter of 2025.

Elsewhere, the technology & electronics sector increased spend on Facebook most during the second quarter, with a rise of 59.1% equivalent to an additional $1.0bn. Tech brands also lifted spend markedly on Instagram (+$501m) and TikTok (+$484m) at this time, pushing their share of spend on these platforms to 7.6% and 15.8%, respectively. In both cases, this makes the tech category the second-largest on TikTok and Instagram, behind retail.

The second quarter windfall across the social media sector is the primary cause for our upgraded global ad forecast this year, the first upgrade to our outlook in more than 12 months.

The new normal: post-pandemic market dynamics

- The global ad market is on course to double in value between 2020 and 2027

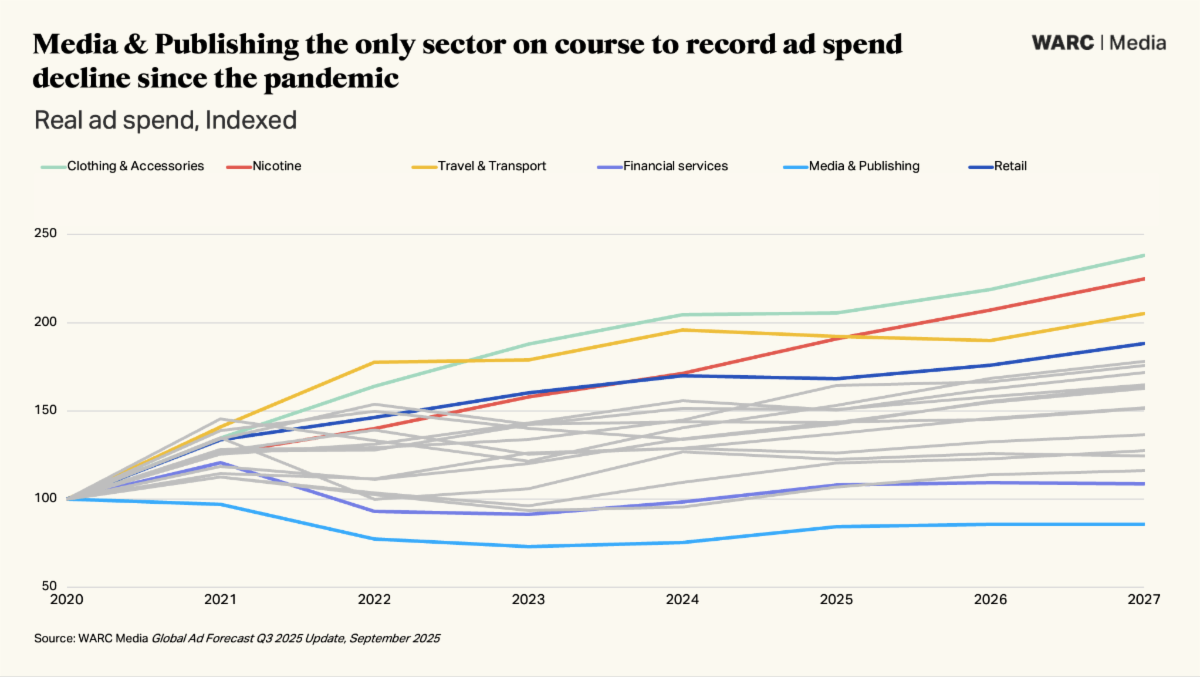

- Analysis of market dynamics following the pandemic shows that clothing, travel and nicotine brands have grown most since the market’s nadir in 2020

- Media & publishing is the only sector on course to record a real terms decline in ad spend between 2020 and 2027

- Magazines (-49.9%), newspapers (-45.8%), broadcast TV (-35.2%), broadcast radio (-25.7%) are all tracking notably lower over the period

- Amazon’s retail platform is the stand-out performer, with real ad revenue in 2027 likely to be 3.1x higher than in 2020

- Alphabet’s real ad revenue is set to be up by two thirds (+66.6%) over the same period, while Meta’s will have near-doubled (+99.2%).

WARC’s forecasts show that, on the current trajectory, the nominal value of the global ad market will have doubled over the seven years since the pandemic.

Real terms – i.e. inflation adjusted – data show that, among the 19 product sectors monitored by WARC, clothing brands are set to have increased spend most since the pandemic, with ad investment 2.4x higher by 2027. Travel & transport is also forecast to double spend by 2027, compared to a period when movement was heavily restricted across most of the globe. Nicotine is the only other sector to have more than doubled spend in that time, in line with the growing penetration of e-cigarettes and vapes around the world.

Conversely, spend within the financial services sector is tracking just 8.6% higher in 2027 than in 2020, likely reflective of lacklustre economic performance and the demise of low-cost credit. Media & publishing is the only consumer-facing sector on course to record a decline since the pandemic, with real spend 14.3% lower in 2027.

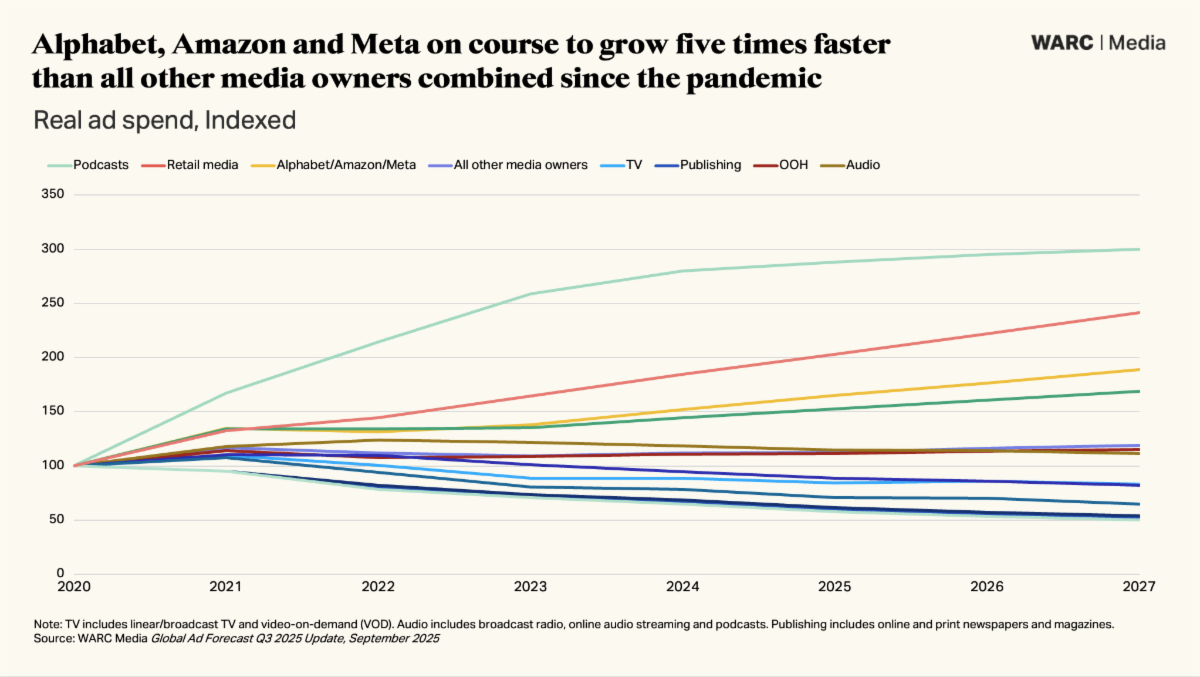

The same analysis at the media level shows that five channels have recorded a decline in ad spend since the pandemic when measured in real terms, including magazines (-49.9%), newspapers (-45.8%), broadcast TV (-35.2%), online classified (-25.4%) and broadcast radio (-17.7%).

Although radio is set to record a dip, overall audio spend is likely to be up marginally (+11.4%) come 2027, with online audio spend tracking 2.5x time higher. This is being driven by a trebling in podcast spend as listening habits changed over the period.

Despite video-on-demand (VOD) spend trebling over the period, total TV in 2027 is still expected to be down by 16.7% in real terms compared to 2020, when production was heavily disrupted and has struggled to fully recover since. Conversely, real ad spend on YouTube is projected to be 85.4% higher in 2027 versus 2020.

Overall, Alphabet’s real ad revenue is set to be up by two thirds (+66.6%) over the period, while Meta’s is set to double (+99.2%). Amazon’s retail platform is the stand-out performer, with real ad revenue in 2027 3x higher than in 2020, when enforced lockdowns drove shopping online.

Taken together, the Amazon, Alphabet and Meta triopoly is on track to record real growth of 89.1% between the pandemic and the end of the forecast period, almost five times faster than all other media owners combined.